Published on: 20/07/2018

Updated on: 22/11/2018

Recognition

TEKUN Nasional has received Shariah-compliant recognition from a Syariah-compliant financing consultant namely the Syariah Center of Excellence Bank Islam Malaysia Berhad in 2017. To date all TEKUN financing products offered to entrepreneurs are fully Shariah compliant.

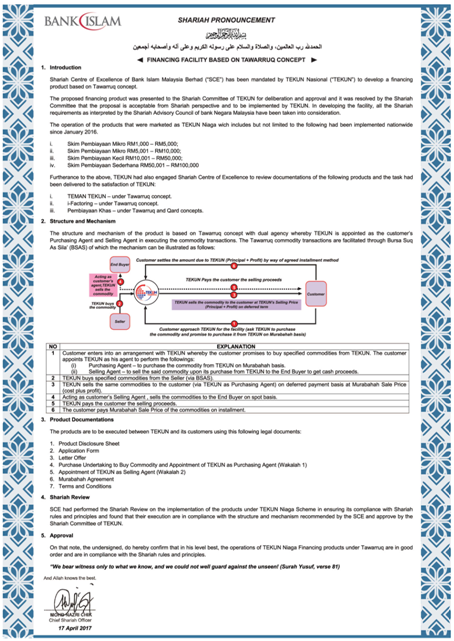

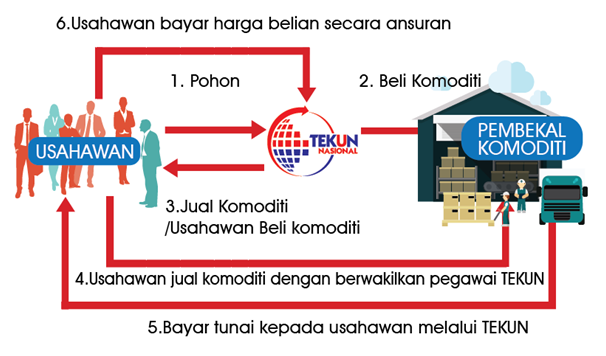

*Information for the following diagram is only in Malay version

Muamalat Concepts And Contracts Used In TEKUN Financing Product

The main concept used in TEKUN financing products is Tawarruq. However, there are also products that use the Qard contract.

Tawarruq

Definition : Silver money, dirham or silver metal

Term : Murabahah commodity trading transactions are based on residual payments from sellers to buyers, and later the commodities will be resold in cash to third parties (other than original sellers) to get cash.

Basically, tawarruq is a concept or system that combines various types of contracts in it. Among the contracts involved are:

Bai’ Murabahah

The sale and purchase contract where the cost of goods and profit rates is known and agreed upon by the buyer. The sale price payment can be made in full or in installments.

Wakalah

Contracts involving one party (Principal / Muwakkil) delegating another party (representative) to perform certain Shariah-compliant tasks, either voluntarily or with wage payments.

Ta’widh

Indemnities imposed on actual losses incurred by TEKUN due to customer delays in repayment of financing. Income from ta`widh can be calculated as TEKUN income.

Gharamah

Fine or penalties imposed on customers who default in paying debts. Gharamah should not be considered as TEKUN income but should be channeled to a charitable or baitulmal body.

Ibra’

Rebate provided by TEKUN to customers who pay off their financing earlier. Ibra ‘clauses are aligned with agreement documents to avoid the issue of uncertainty (gharar) in relation to customer rights.

*Information for the following diagram is only in Malay version

- TEKUN Niaga

- TEMAN TEKUN

- TemanNita

- Kontrak-i

- Special Programmes (Fishermen, Young Agropreneur, Young Professional, Ex-Army Personnel, PPUS, Mentor Mentee, TemanNita PNS)

Qard

Definition: Deduct or borrow

Term : A loan contract involving two parties where the amount of the loan repayment is equal to the amount borrowed.

*Information for the following diagram is only in Malay version

Among the TEKUN products that use this concept is the Special Programme (Azam Tani, PERHEBAT, DVS Johor, UKAS)

Muamalat Concepts And Contracts Used In AR-RAHNU TEKUN Product

Qard

A loan contract involving two parties where the amount of the loan repayment is equal to the amount borrowed.

Rahn

Gold collateral or mortgage contracts as collateral to loans taken. This deposit will be disbursed to cover the remaining loan if the borrower can not afford to pay the loan.

Wadi’ah

A savings contract where the owner hands over gold to the depositor to be kept in a safe place.

Ujrah

Wages or fees charged for the gold storage service provided.

Advantages of Shariah-Compliant Financing

- Able to keep away from sin and usury that Shariah prohibits.

- Making the financing provided to entrepreneurs halal in Islam.

- Making the income earned by TEKUN halal.

- Making the livelihood earned by entrepreneurs more blessed.

- To make the heart more calm.

- Improve livelihood and solve problems in life.

FAQ

Is Shariah-compliant financing offered to all TEKUN Nasional entrepreneurs nationwide?

Yes. Shariah-compliant financing is offered to all entrepreneurs irrespective of their religious status and beliefs. This is because such financing will affect two parties namely TEKUN and entrepreneurs whereas TEKUN will benefit from the funding provided. To ensure the profit is halal then financing transactions need to be done in a Shariah-compliant manner.

Is the profit rate of shariah-compliant financing lower than the conventional loan interest rate?

Not necessarily. However, shariah-compliant financing can be the solution to anyone who wants to keep away from usury which is prohibited by Shariah.

What are the terminologies changed after using a Shariah-compliant concept?

Among the converted words are loans to financing, charges to profit rates, insurance to takaful, rebate to ibra’, borrower to financing receiver or entrepreneur, loan balance to financing balance and fee to wakalah fee.